In many parts of Florida, there are restrictions, taxes, and local rules that govern the use of real estate as a rental property. You apply for this once when you buy the house, and it renews every year.

If you plan to live in the house you're buying in Florida, there's a special tax exemption (known as the Homestead Exemption), that excludes the first $25,000 of your home's assessed value from property taxes. If you plan to buy in an area (like most of Florida) that is particularly flood-prone or hurricane-prone, your lender might require you to carry flood insurance, windstorm insurance, or both, in addition to standard homeowners insurance. Pay extra attention to any termite damage found during your home inspection. Termites are a potential problem everywhere, but can be an especially big problem in warmer climates. While most of the things to know before buying a home in Florida apply pretty much everywhere (like credit scoring requirements), there are a few state-specific things to know.

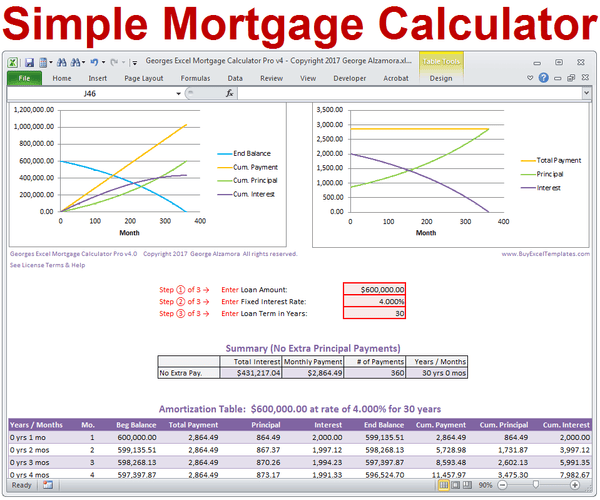

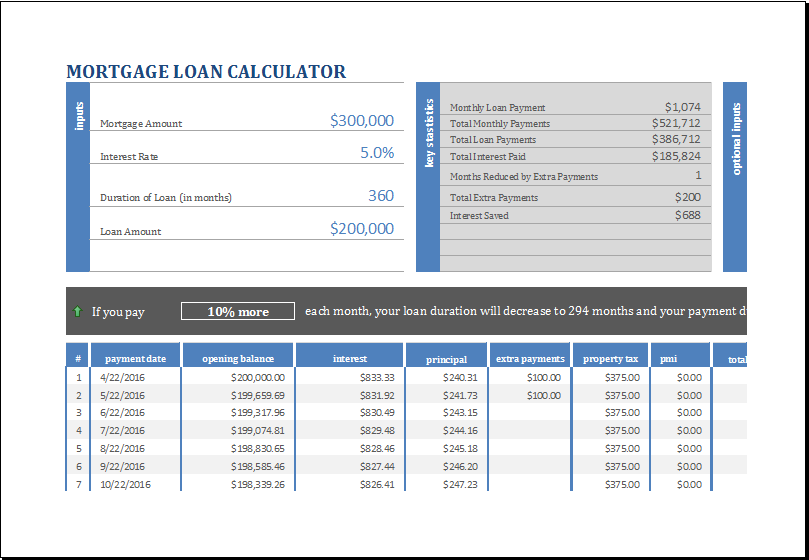

Things to know before buying a house in Florida For this reason, lenders often abbreviate your mortgage payment as PITI (principal, interest, taxes, and insurance). Most lenders require that you pay a monthly portion of your property taxes and insurance along with your principal and interest payment, and some even make you pay your HOA fees. It's also worth noting that this formula only calculates the principal and interest portion of your mortgage payment. Here's how these three variables fit into the formula to calculate your monthly mortgage payment, which we'll call "M": The two most common mortgage terms are 30 and 15 years, which translate to 360 and 180 monthly payments, respectively. Take the number of years in the loan's term and multiply by 12.

Note that if you have an adjustable-rate mortgage, the calculation only tells your initial mortgage payment. For example, if your loan's interest rate is 4%, convert it to 0.04, then divide that by 12, which gives you a monthly rate of 0.0033. One caveat, though - before you use the mortgage formula, convert your interest rate to a decimal, and then to a monthly interest rate (because you're calculating your monthly mortgage payment).

0 kommentar(er)

0 kommentar(er)